Multiple RETT events in Transactions with a Rolling Vendor

Especially in proprietary transactions, founders and shareholding managers regularly maintain a function in the target company and reinvest into the acquisition structure.

To avoid dry taxable income, the reinvestment shall often be structured as a tax-neutral share-for-share exchange, where less than 100% of the shares are sold while the remainder is “rolled” into the investor’s structure.

Caution is required in cases where a target entity holds German real estate as the (in)direct transfer or unification of a ≥90% stake in such entity triggers real estate transfer tax (“RETT”) and, in multi-tier acquisition structures, a roll-over through the shareholding chain may trigger multiple RETT events.

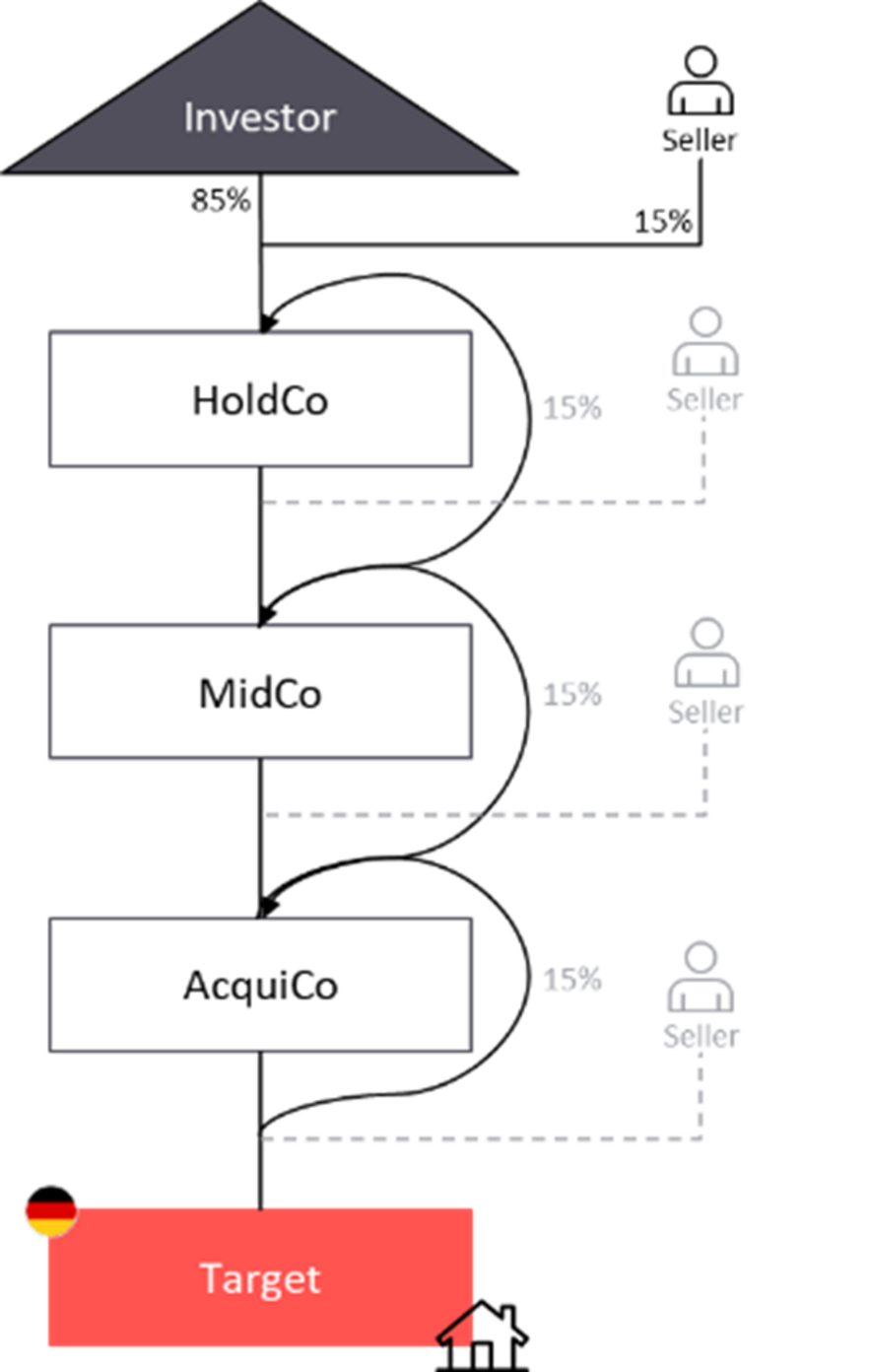

In a simplified example (no debt financing of AcquiCo), 85% of the shares in the Target shall be disposed, while a 15% stake shall be reinvested tax-neutrally through a share-for-share exchange1 as follows:

i. Seller sells 85% of the shares and contributes the remaining 15% into AcquiCo in exchange for new AcquiCo shares (15%).

ii. Seller contributes the new AcquiCo shares received in step i. into MidCo in exchange for new MidCo shares (15%).

iii. Seller contributes the new MidCo shares received in step ii. into HoldCo in exchange for new HoldCo shares (15%).

As a result, the Seller holds a 15% stake in HoldCo alongside the Investor. For RETT purposes, each of the three contribution steps above qualifies as a separate taxable event:

Step i. triggers a first RETT event pursuant to Sec. 1 para. 2b RETTA at Target (transfer of ≥90% to new shareholders) upon Closing of the purchase and contribution agreement. While the Signing also triggers a RETT event pursuant to Sec. 1 para. 3 RETTA at AcquiCo (transfer of ≥90% to AcquiCo), the RETT assessment for such event can be revoked via the corrective provision of Sec. 16 para. 4a RETTA presented in more detail below.

Step ii. triggers a second RETT event pursuant to Sec. 1 para. 3 RETTA at MidCo (unification of ≥90%) as it held only 85% of the shares before but 100% of the shares after this second contribution.

Step iii. triggers a third RETT event pursuant to Sec. 1 para. 3 RETTA at HoldCo (unification of ≥90%) as it held only 85% of the shares before but 100% of the shares after this third contribution.

In practice, such multiple RETT events sometimes cannot be avoided as a tax neutral share-for-share exchange in each contribution step requires a capital increase. An alternative structure comprising a 100% sale against cash and a purchase price receivable, subsequently contributed into HoldCo against 15% new HoldCo shares, may trigger substantial dry taxable income in relation to the roll-over shares (potentially outweighing two times RETT). In relevant cases, the additional tax costs should be considered in the acquisition structure and negotiation.

The legislator applies the so-called “Signing-Closing theory”, according to which the transfer of ≥90% of the shares can trigger two separate RETT events upon Signing (Sec. 1 para. 3 RETTA) and Closing (Sec. 1 para. 2a or 2b RETTA, depending on whether the real estate is attributed to a partnership or corporation) if there is a time gap between Signing and Closing.

With the Annual Tax Act 2022, Sec. 16 para. 4a RETTA was newly introduced to prevent double taxation from such events. Under this provision the RETT event for Signing shall be revoked or amended by application upon Closing. This, however, only applies if both events were timely2 and completely notified to the competent tax office (Sec. 16 para. 5 RETTA).

To avoid potential double taxation of the same transaction upon Signing and Closing, it should be made sure that all RETT events are notified timely and completely by the relevant taxpayer(s) to the competent tax office.

In determining the RETT event and relevant taxpayer, the attribution of the underlying real estate is decisive.

According to a recently published decree3, the tax authorities take the view that for RETT purposes:

In the example above, this would mean that, following the contribution steps, the real estate is attributed to both Target and HoldCo.

In multi-tier structures, this view adds further complexity to determining RETT events, the relevant taxpayer, as well as respective notification obligations and may trigger a potential double taxation.

Whenever shares in a company with real estate located in Germany are directly or indirectly transferred, caution is required and RETT implications must be assessed carefully. The complexity of German RETT law in connection with share deals is evident from the simple example presented above.

The current legislative processes regarding RETT, whether still in discussion (such as the discussion draft for the RETT Act (“Grunderwerbsteuer-Novellierungsgesetz”)) or already under way (imminent entry of the Act to Modernize the Law on Partnerships (MoPeG) on 1 January 2024 and its implications on RETT exemptions under Sec. 5 and 6 of the RETTA) must be closely monitored. All in all, it is – however – highly unlikely that the legislative efforts will lead to an overall simplification of German RETT law. The tax authorities’ interpretation of numerous RETT aspects is increasingly seen as excessive by many experts and will keep the fiscal courts busy in the coming years.

[1] Sec. 21 para. 1 S. 2 RTA (Reorganization Tax Act – Umwandlungssteuergesetz)

[2] Within two weeks in the case of a German buyer or, respectively, one month in the case of a foreign Buyer.

[3] Decree of the tax authorities dated 16 October 2023, 31-S 4501/18#01#07, FMNR202301832.